Bankruptcy filings stay high in state

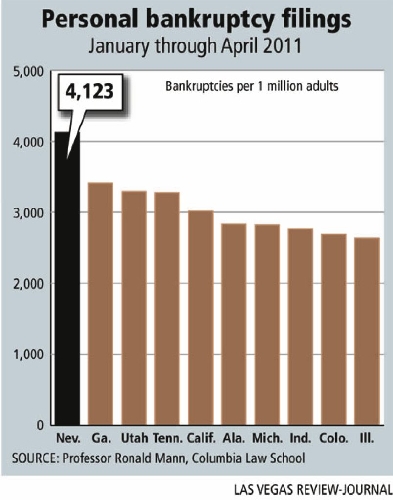

Nevada continues to lead the nation in the number of per capita personal bankruptcy filings in the first four months of this year.

Nevada topped the list of states, with 4,123 bankruptcies per million adults through April, Columbia Law School professor Ronald Mann reported. Georgia comes was second at 3,412. California was fifth at 3,017.

Though high, Nevada's rate has dropped 15 percent, compared with 2010, Mann said in a statement.

"The disparity underscores how out of line filings in Nevada were last year when they were more than 50 percent higher than those in any other state for much of the year," Mann said.

However, the number of personal bankruptcy filings for Nevada declined in each of the first four months from the level a year ago.

Bankruptcy filings of all types, including business and personal, declined 1 percent, to 24,273 last year, from the total for 2009, federal statistics show.

Bankruptcy filings are a lagging economic indicator, said Stephen Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

"The Southern Nevada economy really stabilized in the second half of last year," Brown said. "And I think it actually improved from the statistics we've seen so far for this year."

Bankruptcy filings will start to decline as the number of debtors likely to file for bankruptcy shrinks and as the economy improves, he said.

Bankruptcy attorney Lenard Schwartzer said individual bankruptcies may have topped off.

"In other words, they don't seem to be growing, but there doesn't seem to be a substantial decrease," he said.

However, Schwartzer sees a big increase in business bankruptcy filings as commercial real estate owners who obtained loans several years ago now face balloon payments and cannot get refinancing.

Bankruptcy attorney Frank Sorrentino, who handles a large volume of bankruptcy filings for individuals, said homeowners are turning to bankruptcy when they can't make mortgage payments and can't get modifications. In other cases, homeowners file because they realize their house is underwater or because of medical bills, credit card debts and payday loan payments. More than one-fifth of his clients are unemployed, he said.

Bankruptcy attorney Brian Shapiro said personal bankruptcy numbers remain steady while commercial bankruptcy filings are trending up.

Banks lending to businesses a few years ago often extended loans in hopes that the borrower would recover, bankruptcy attorney Rob Charles said.

"The lenders (now) are kind of looking at these bad debts and saying, 'Giving it more time is not going to make it a good deal,' " he said.

Greg Garman, managing shareholder at the law firm Gordon Silver, agreed with Charles.

A few years ago, he said, many single-asset real estate companies negotiated forbearance agreements with banks. In other words, banks agreed to give the borrower time to recover, rather than proceeding immediately to foreclosure.

"These forbearances are starting to come to an end," Garman said.

Contact reporter John G. Edwards at

jedwards@reviewjournal.com or 702-383-0420.