Wells Fargo tops deposit list

The bank with the stagecoach logo holds the biggest share of Nevada deposits, bypassing previous Nevada leader Bank of America, the latest numbers from the Federal Deposit Insurance Corp. show.

Kirk Clausen, Wells Fargo Bank's regional president for Nevada, admitted that banking has become so complex that FDIC statistics on deposit totals sometimes are skewed, although he said his bank has seen its deposit total jump recently.

Bank of America and Wells Fargo have been trading the lead in total deposits for several years.

"I wouldn't brag about (being first), because it could change again," Clausen said. "Bank of America is a great competitor."

Clausen said he is friends with top regional executives for Bank of America and US Bank, another large regional bank.

"We don't get together and talk about who is the bigger bank, because there is no way to prove who is the bigger bank," he said.

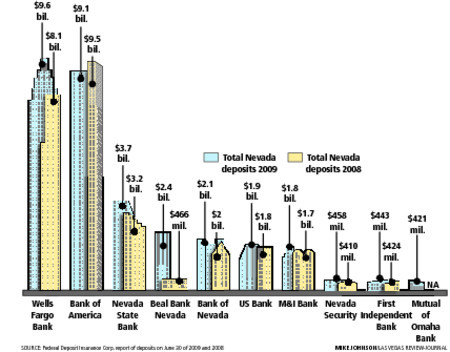

Wells Fargo Bank's total Nevada deposits grew by 18 percent to $9.6 billion as of June 30, the latest date for deposit totals from the FDIC.

For the calendar year to date, Clausen estimates deposits are up about 17 percent, a figure that excludes deposits in wealth management accounts and casino accounts. Nor does it include Wachovia Bank deposits, which Clausen said total about $1.3 billion and are reported separately even though Wells Fargo acquired Wachovia in December 2008.

By contrast, federal statistics show that Bank of America's total Nevada deposits dropped by $411 million, or 4 percent, to $9.1 billion.

Bank of America spokeswoman Britney Sheehan said the numbers don't reflect the bank's retail market position in Nevada.

"The drop was due to reclassification of certain corporate deposits," she said.

After scrubbing the data, Bank of America said retail deposits increased 2 percent, she said, declining to provide a total dollar amount.

Clausen said he believes Bank of America's own number, but another who spoke anonymously said customers earlier this year were pulling deposits from Bank of America.

The competitor attributed the withdrawals to fears about the giant bank's financial soundness and to continual national news about BofA getting federal bailout funds and paying bonuses to Merrill Lynch executives after acquiring the stock brokerage.

In some cases, the deposit totals raise more questions than they answer. Beal Bank Nevada boosted its deposits to $2.4 billion from $466 million last year. Why?

A spokesman for the privately held bank did not return a call for comment Friday afternoon.

The latest deposit totals for Nevada show Citibank leads with $100.3 billion. However, a large portion of those deposits are related to the bank's credit card processing center, rather than its retail banking operations in Nevada. Charles Schwab Bank, which is affiliated with the similarly named discount stock brokerage, comes next. However, Charles Schwab Bank has customers around the country, not just in Nevada.

JPMorgan Chase Bank comes in third but a spokesman said the total is not solely from Nevada depositors.

Mutual of Omaha Bank, which took over First National Bank in summer 2008, reported $421 million in Nevada deposits, down from $1.2 billion the prior year for First National.

Spokesman Jim Nolan said the bank reclassified bank deposits, which contributed to the dramatic change. In addition, Mutual of Omaha Bank relies less on deposits sold through stockbrokers than First National did, Nolan said.

Clausen attributed Wells Fargo's deposit growth to customers who moved some of their money to Wells Fargo because they consider it financially stronger than some of its competitors and they like its money management technology.

The deposits have come from credit unions, small and midsize banks and non-bank sources, such as money funds, he said.

Wells Fargo also attracted deposits from customers of banks that failed in Southern Nevada, he said.

"We're stable. We're deliberate. We're always there. We may be a little bit boring," the Wells Fargo executive said. "We have more locations, more ATMs, more geographic distribution through the state than any of our competitors."

Total Nevada Total Nevada

deposits 2009 deposits 2008

Wells Fargo Bank $9.6 bil. $8.1 bil.

Bank of America $9.1 bil. $9.5 bil

Nevada State Bank $3.7 bil. $3.2 bil.

Beal Bank Nevada $2.4 bil. $466 mil.

Bank of Nevada $2.1 bil. $2 bil.

US Bank $1.9 bil. $1.8 bil.

M&I Bank $1.8 bil. $1.7 bil.

Nevada Security $458 mil. $410 mil.

First Independent Bank $443 mil. $424 mil.

Mutual of Omaha Bank $421 mil. NA

SOURE: Federal Deposit Insurance Corp. report of deposits on June 30 of 2009 and 2008

MIKE JOHNSON/LAS VEGAS REVIEW-JOURNAL

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420